2021. 9. 13. 22:30ㆍ카테고리 없음

,

- Vista Equity Partners Standard Operating Procedures Llc

- Vista Equity Partners Standard Operating Procedures Accounting

- Vista Equity Partners Standard Operating Procedures For Restaurants

-

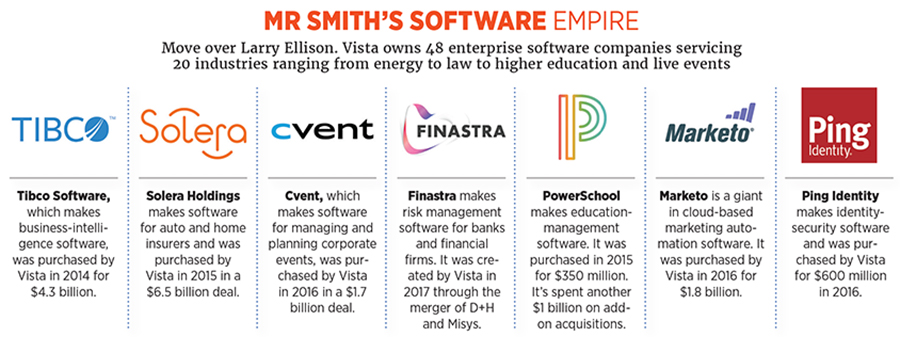

TIBCO Software Inc., a global leader in infrastructure and business intelligence software, today announced that it has been acquired by Vista Equity Partners. The transaction, originally announced September 29, 2014, closed Friday, December 5, 2014. TIBCO's shareholders approved the agreement on Wednesday December 3, 2014. Following the transaction, Murray Rode was named the Chief Executive Officer of TIBCO. Vivek Ranadivé will remain a Board Member of TIBCO and will assist the company with strategic projects. TIBCO will continue to operate as TIBCO Software Inc.

'We see tremendous value in TIBCO's ability to empower customers to extract and act on information utilizing TIBCO's fast data platform,' said Robert F. Smith, chairman and chief executive officer, Vista Equity Partners. 'We understand the added expertise TIBCO can bring to customers and the marketplace, and we're incredibly excited to work with the management team to help TIBCO reach its full potential.'

Once a transaction has been consummated, Vista begins implementing their Vista Standard Operating Procedures (VSOPs), a proprietary suite of (currently) 83 constantly changing operating principles and tactics designed to increase revenues and margins. The company only makes a small number of investments per year and thus places quality over quantity. Its investment process looks to firms that can be acquired and can benefit from the Vista SOPs and become companies with predictable, high cash flows. Adding value is a guiding principle of Vista Equity Partners. Vista Equity Partners is a low volume, high value-add firm that makes only a limited number of investments per year. Vista's investment process continually identifies specific companies that can be acquired and transformed through the implementation of the Vista SOPs into predictable, high cash flow businesses. The company only makes a small number of investments per year and thus places quality over quantity. Its investment process looks to firms that can be acquired and can benefit from the Vista SOPs and become companies with predictable, high cash flows. Adding value is a guiding principle of Vista Equity Partners. This week the Journal notes that Robert Smith’s Vista Equity Partners has achieved exceptional results by buying software companies and then applying a standard formula for operating them.

TIBCO also announced the appointment of Murray Rode as new Chief Executive Officer. For more than 15 years, Murray has served in a variety of key leadership roles within TIBCO; most recently he served as the Chief Operating Officer.

'We are very pleased to have this transaction completed. We believe this is the right direction for TIBCO's long-term strategy and will better serve our customers and employees,' said Murray Rode, chief executive officer, TIBCO. 'I look forward to working with Vista Equity Partners as TIBCO enters its next chapter of innovation, growth and leadership.'

'With today's announcement, I will step down as chairman and CEO of TIBCO,” said Vivek Ranadivé. 'I firmly believe that taking the company private with a partner like Vista puts TIBCO in the perfect position for its next chapter. After many years as founder, chairman and CEO, I felt the timing was right for me to pursue exciting new opportunities while continuing to serve as a board member. I am so proud of the great team at TIBCO and am excited about our future. Murray has been by my side every step of the way as we built this company, and he will make an excellent CEO.'

Vista Equity is a leading private equity firm with over $14 billion in cumulative capital commitments, focused on investments in software, data and technology-enabled service companies. Vista has an extensive track record of successfully completing take-private transactions, including taking five other public companies private in the past three years. The firm helps its companies achieve operational, product and customer service excellence by contributing professional expertise, proven best practices and management techniques.

About Vista Equity Partners

Vista Equity Partners, a U.S.-based private equity firm with offices in Austin, Chicago and San

Francisco, with over $14 billion in cumulative capital commitments, currently invests in dynamic,

successful software, data and technology-based organizations led by world-class management teams with long-term perspective. Vista is a value-added investor, contributing professional expertise and multi-level support towards companies realizing their full potential. Vista’s investment approach is anchored by a sizable long-term capital base, experience in structuring technology oriented transactions, and proven management techniques that yield flexibility and opportunity in private equity investing. For more information, please visit www.vistaequitypartners.com.

Aug 31, 2010 One of the easiest way to write standard operating procedures is to see how others do it. What I’ve done this week is share 7 examples of different standard operating procedures examples (also called SOPs) so you can see how different organizations write, format, and design their own procedures. Over the coming weeks, we will analyze these documents and prepare a series of templates that. Standard Operating Procedures (SOP) Administration Page # 10/5/20154 of 8 Date Last Reviewed/Updated Title of SOP Author HR Manager Date of Approval 10/2015 4 o Customer Service: Ability to identify customers, determine the valid needs of a situation, and provide service or service recovery in a manner that satisfies the customer. Business Management Daily has rereleased our very popular Standard Operating Procedure manual for administrative professionals. Many of our readers have requested this SOP manual, which provides a detailed example of the day-to-day activities conducted by an organization’s admins. May 04, 2019 Vista Equity Partners, which invests primarily in software and technology-enabled companies, applies a set of more than 50 proprietary standard operating procedures in areas such as product development, sales and marketing, customer support, professional services.

Glassdoor has 23 Vista Equity Partners reviews submitted anonymously by Vista Equity Partners employees. Read employee reviews and ratings on Glassdoor to decide if Vista Equity Partners is right for you. Encyclopedia of general knowledge by jahangir success series pdf.

Vista Equity Standard Operating Procedures Manual Template Download

By Hugh MacArthur, Graham Elton, Daniel Haas and Suvir VarmaHigh asset prices and less confidence in market beta to lift returns in recent years have greatly narrowed the margin of error for private equity firms to deliver acceptable returns. Some general partners have looked back at the past decade of trials and errors to identify lessons and patterns that will shape their next approach to value creation. They have drawn up playbooks consisting of detailed, sequenced actions taken over time to maximize value from each investment.

Feb 12, 2018 - Frozen (2013) NL Gesproken. Geplaatst door Dutch-Movies Geplaatst op woensdag, mei 07. Alle films op deze website zijn te downloaden. ITA.eNG.MD.BrRip.720p.x264.TrTd_TeaM, 0, 0, Nov. 11th '12, 790.0 MB0, AsPiDe. K3-Doornroosje, de Musical (2009) DVDR(xvid) NL Gespr DMT, 1, 0, Nov. Torrent doornroosje nl gesproken. Results 1 - 7 - Come and download doornroosje absolutely for free. K3-Doornroosje, de Musical (2009) DVDR(xvid) NL Gespr DMT Posted by IamMarretje in. Download K3-Doornroosje, de Musical (2009) DVDR(xvid) NL Gespr DMT torrent or any other torrent from Other Movies category. Torrent Doornroosje Nl Gesproken. July 1, 2017. Autodesk Maya 2015 Crack Kickass Torrent. July 1, 2017.

Dec 8, 2007 - Service Pack 1 provides the latest updates to Microsoft Office Visio 2007. Free download microsoft visio 2007. May 5, 2009 - Visio - Software Upgrade Assessment. Microsoft Office Visio 2007 Professional - Software Upgrade Assessment Add-In. Dec 23, 2017 - Here you can download Microsoft Office 2007 Portable setup for free. Yes MS Office 2007 portable is here which can be carried anywhere. May 5, 2009 - 2007 Microsoft Office Add-in: Microsoft Save as PDF or XPS. This download allows you to export and save to the PDF and XPS formats in eight.

The application of a playbook to a target company will depend on three factors. The first is the industry, as specific cost bases and capabilities have more or less relevance to individual industries. Manufacturing optimization clearly looms large in the chemical industry, and marketing and branding figure prominently in consumer products.

The second factor is the investment thesis: A playbook suited to a target company that has solid operations and is poised for growth may not work with a bloated company in distress. Third, the playbook should accommodate the target’s strategy to move the business forward. Companies competing in the same market can have very different strategies, and strategy determines where a PE firm can cut costs and where it should double down on investment.

Given these factors, PE firms with the most highly developed playbooks today tend to define their deal sweet spots narrowly. They may focus on investments in a single industry or on businesses across industries but with similar investment theses and opportunities for creating value.

Vista Equity Standard Operating Procedures Manual Template Free

Vista Equity Partners, which invests primarily in software and technology-enabled companies, applies a set of more than 50 proprietary standard operating procedures in areas such as product development, sales and marketing, customer support, professional services and general administration. Vista’s in-house consulting group works with investment professionals and portfolio company executives to apply those best practices. In a recent case, Vista sold TransFirst, a payment processor that Vista had acquired for $1.5 billion a little more than a year earlier, for $2.35 billion. PE Hub reported that Vista focused on building out TransFirst’s back-end settlement capability while enhancing its sales channels.

Vista Equity Partners Standard Operating Procedures Llc

3G Capital has a well-defined playbook that applies zero-based budgeting to consumer products or retail companies. This differs from traditional budgeting processes by examining all expenses for each new period, not just incremental expenditures in obvious areas. A zero-based approach puts the onus on managers to justify the costs that need to be kept—a subtle but powerful shift in perspective from what should be removed. Teaming with Berkshire Hathaway to acquire Heinz, 3G eliminated roughly 7,000 lower-value positions and rationalized corporate and manufacturing footprints. 3G’s plays raised EBITDA margins from 18% to 26%. After aggressively expanding margins, 3G ran another play from its book, successfully merging Heinz with Kraft.

While many playbooks started with a focus on cost reduction, the most successful ones today contain a strategic blend of cost and growth moves. Cost cutting is no longer sufficient on its own to generate strong returns. To reliably create value and obtain the desired multiple upon exit, a portfolio company must be set up to achieve profitable growth over the long term.

Vista Equity Standard Operating Procedures Manual Template Pdf

Audax, for example, focuses exclusively on finding solid middle-market companies that it can transform, through add-on acquisitions, into market leaders. Since its inception, Audax has invested $4 billion in 101 platform investments and 534 add-on acquisitions, often in fragmented markets. In one example of its buy-and-build playbook, Audax bought Advanced Dermatology & Cosmetic Surgery, a US physician practice with a strong presence in Florida and Ohio. Some 40 add-ons and five de novo clinics later, Audax had built the business into a national platform and invested in centralized support services, resulting in expanded relationships with payers and higher clinic utilization rates. Since its initial investment in 2011, revenue quadrupled to more than $200 million, and Audax sold the asset to PE firm Harvest Partners in 2016, retaining a minority stake.

All PE firms want to create value as quickly as possible—to grow revenue and take out cost—and a strong playbook helps to accomplish that.

Vista Equity Partners Standard Operating Procedures Accounting

Read more: Global Private Equity Report 2017

Vista Equity Partners Standard Operating Procedures For Restaurants

Alpha kappa alpha undergraduate intake manual. Hugh MacArthur, Graham Elton, Daniel Haas and Suvir Varma are leaders of Bain & Company’s Private Equity practice.